Argentines are no strangers to economic upheaval, having experienced a number of financial crises in the past decades.

But with inflation rising above 100% and the value of the Argentine currency – the peso – plummeting, even some of the most crisis-hardened Argentines are struggling to make ends meet amid fast-changing prices and a soaring cost of living.

Reporter Valley Fontaine spoke to five Argentines about their strategies to make ends meet.

1. Buy now, pay later

Argentina’s year-on-year inflation rate soared past the 100% mark in February for the first time in more than 30 years.

That means that the prices of many consumer goods have doubled in the space of just a year.

So saving up for a special purchase or even everyday goods can mean that you will end up paying a higher price in a few months or even weeks down the line.

The answer? Using interest-free credit.

Monica, a digital artist from Buenos Aires, has the buy-now-pay-later approach down to a fine art.

The 27-year-old takes advantage of the interest-free credit options offered by many supermarkets and clothes shops.

“I buy everything on interest-free instalments. Payments are usually spread over 3 months or more,” she explains.

So even if Monica does not have the money to buy a pair of shoes costing 20,000 pesos outright, she will try to buy them in four 5,000-peso instalments, rather than risk returning to the shop once she has saved up 20,000 pesos and risk the shoes’ price having risen to 25,000 pesos.

“If I can’t pay in instalments, I usually won’t buy it,” she says.

2. Barter or swap

With prices rising so rapidly, some Argentines are running out of cash at the end of the month and can not even afford the basics.

Teresa, a cleaner from the city of Mar del Plata, spends most of her income on rent.

Another big chunk goes on travelling to the homes she cleans. She spends at least four hours a day on public transport.

With very little disposable income and hardly any spare time, the 31-year-old has few options to make her money stretch further.

“When I run out of money, I will hitchhike or walk,” she says.

But what about other expenditures? Teresa says that finding people who are in a similar situation has helped her get by without cash.

“I joined a club where people swap items. Last week, I swapped a pair of shoes that one of my clients gave me in exchange for milk, toothpaste, bread and other food items.”

3. Bulk buying

But even for those who may have some money left at the end of the month, skyrocketing inflation is proving a problem.

Saving pesos when inflation is this high means your savings will devalue quickly.

If you put 100,000 pesos in your savings account in February 2022, you will have 100,000 pesos plus interest a year on. But as the rate of interest is lower than the rate of inflation, your pesos will be worth less than they were a year ago.

So what do Argentines do with money they may have left over at the end of the month?

Noira, a nurse from the city of Mendoza, says she tries to buy large quantities of goods that will not go off.

“I buy popular non-perishable things like coffee and toilet paper in bulk to prevent the devaluation of my salary,” the 59-year-old explains.

She stores these items in a room in her flat and tries to sell those she does not use herself to friends and colleagues.

With the peso so volatile, she tries to exchange anything left over from her bulk buys for dollars.

The US currency is seen as a much safer investment. In fact, the dollar has been gaining in value against the peso rapidly.

In one day in April, it went up by 7% in just 24 hours.

4. Buying dollars

Even though the peso is Argentina’s national currency, many Argentines like Noira have little faith in it and prefer to convert any spare pesos into dollars.

Business student Jorge, 23, not only has more faith in the stability of the dollar than the peso, he also has little trust in Argentina’s banks and therefore prefers to keep his dollars at home.

His distrust of the banking system is rooted in his family’s experience of Argentina’s 2001 crisis, when the government at the time put limits on the cash Argentines could withdraw from their bank accounts.

Banks collapsed, with people’s life savings lost for good. Jorge’s father lost savings worth $60,000 (£47,500).

“When the banks went bankrupt and wouldn’t give us our money back, we had to sell our home,” he recalls.

More than 20 years later, he, like many other Argentines, remains wary of entrusting banks with his savings.

“I am too scared to put my money in the bank, so I buy US dollars with any unspent income that I earn. ”

But buying dollars in Argentina is not a simple transaction.

The government has limited the amount of dollars Argentines can buy at banks or official currency exchanges to $200 a month, to avoid its limited deposits of dollars being depleted.

This has led to a vibrant informal market in dollars emerging where the US currency – dubbed the blue dollar – is sold at much higher prices.

Although technically illegal, many Argentines like Jorge view it as necessary to access foreign currency.

“Buying dollars is not cheap, because I have to buy most of them at the higher ‘blue’ dollar rate,” he says,

On 30 April, Jorge paid 469 pesos for just one dollar on the informal market. But he reckons it is an investment worth making, because he thinks the dollar will hold its value, unlike the peso.

5. Spend, spend, spend

But with the blue dollar to peso rate so high, many Argentines’ income does not stretch to purchasing the US currency, even if they do see it as a safer option.

“I can’t afford to buy dollars and my pesos devalue in my hands,” says 25-year-old shop assistant Roberta.

So rather than seeing her spare cash lose value, she spends as much as she can “as quickly as possible”.

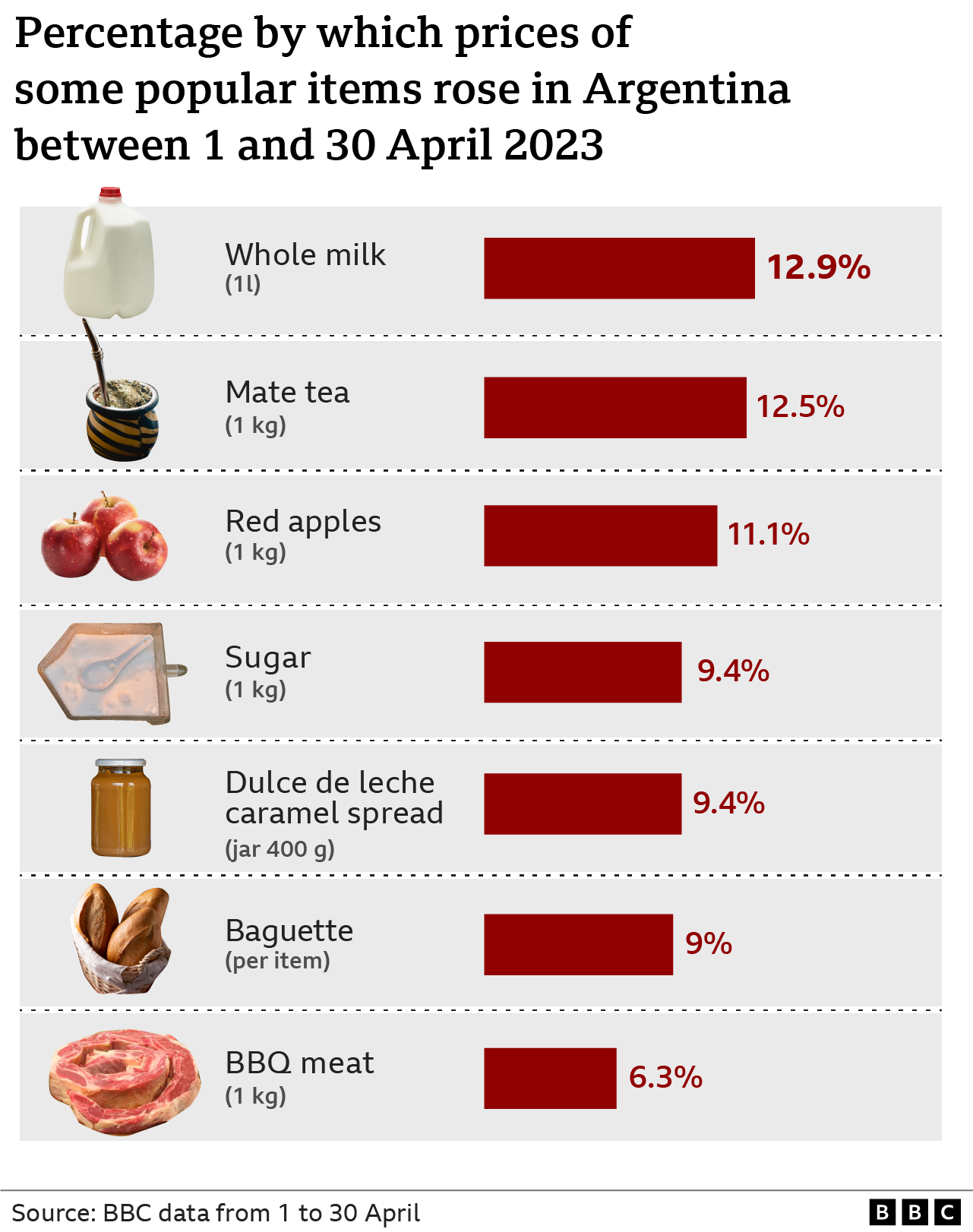

With prices rising by 6-10% per month, this is a widespread practice. But with inflation on the rise, what she gets for her pesos is less every month.

“Each month, I can’t afford to buy what I bought the month before.”