Interest rates are expected to rise for the 14th time in row as the Bank of England continues its battle to control stubbornly high price rises.

Most economists have predicted the Bank will increase its base rate to 5.25% from its current 5% later on Thursday.

That would mean higher interest rates on mortgages and loans for some people, but also higher savings rates.

UK inflation, the rate at which prices rise, is much higher than usual and putting households under pressure.

The last time interest rates stood at 5.25% was 15 years ago in April 2008. However, a rise to 5.25% would mark a smaller increase than July’s dramatic rise to 5% from 4.5% and follows signs that price rises have begun to ease.

Inflation fell by much more than expected in June and at 7.9% is at its lowest level in over a year – but still much higher than the 2% that the Bank aims for.

Pantheon Macroeconomics said this meant policy makers would not need to hike interest rates as much as previously thought.

By making borrowing more expensive the Bank’s aim is that people will spend less money, meaning households will buy fewer things and then price rises will ease.

But it is a balancing act as raising rates too aggressively could cause the economy to slump, but not raising them at all could lead to inflation rising even more.

Free market think tank the Institute of Economic Affairs (IEA) said the Bank should wait for previous interest rate rises to take effect before raising rates further.

”It will take some time for previous rate rises and falling global commodity prices to feed into lower inflation.

“Further rate rises are unnecessary and could do some economic damage without lowering inflation any faster. The UK economy is on the precipice of a sharper slowdown,” said Trevor Williams, a member of IEA and former chief economist at Lloyds Bank.

Andrew Bailey, the Bank of England’s governor, has previously denied the Bank has been trying to cause a recession – which is typically when the economy shrinks for two three-month periods – in a bid to tackle soaring prices.

“Many people with mortgages or loans will be understandably worried about what this means for them… but inflation is still too high and we’ve got to deal with it,” he said at the Bank’s previous interest rate decision.

There are signs that higher rates are already affecting the UK economy with house prices falling at their fastest annual rate in 14 years in July, according to Nationwide.

On Wednesday, Prime Minister Rishi Sunak told LBC radio that inflation was not falling as fast as he would like, but that he believed people could “see light at the end of the tunnel”.

What’s the impact?

A rise in rates would affect different people in different ways.

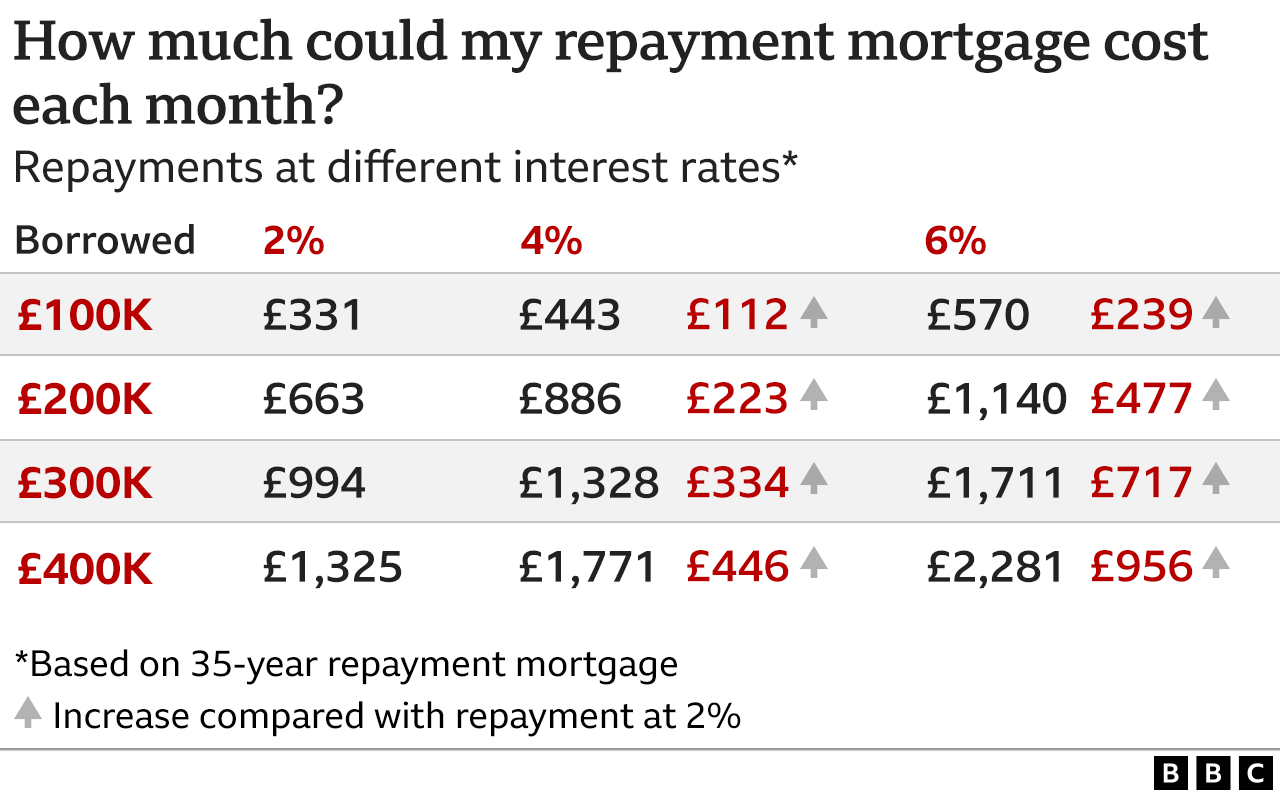

Mortgage holders with variable or tracker mortgages, or those who are looking to secure a new fixed-rate deal, will find it costs more to borrow the money for their homes.

The majority of mortgage holders are on fixed-rate deals, which shields them from the current interest rates rises, but about 800,000 deals will end by the end of this year and 1.6 million more will do so in 2024.

In the event of a 0.25% increase, people on a typical tracker mortgage will cost about £23.71 more a month, while those on standard variable rate (SVR) mortgages face a £15.14 jump on average.

Other impacts of higher rates include first-time home buyers being priced out of the market, and also charges on some un-fixed loans and credit cards going up.

However, people with savings should get better returns on their money – though banks have been condemned for “weak excuses” over their savings rates on offer.

For the government though, a rise in rates will have a knock-on effect meaning it has to pay more interest on the country’s debt.