Slowing food prices helped drive a surprise fall in inflation in August, with the cost of living now at its lowest level in a year and a half.

Inflation, which measures how prices change over time, fell to 6.7% in the year to August, down from 6.8% in July, official figures show.

It is the third month in a row that the figure has dropped.

Price rises for milk, cheese and eggs slowed the most, while fish and vegetable prices also eased.

There was also a drop in hotel and air fare costs, although fuel prices jumped.

When the rate of inflation falls, it does not mean prices are coming down, but that they are rising less quickly.

August’s figure was a surprise as many economists had expected the figure to increase due to rising fuel prices.

Chancellor Jeremy Hunt said the news showed “the plan to deal with inflation is working”.

“But it is still too high which is why it is all the more important to stick to our plan to halve it so we can ease the pressure on families and businesses. It is also the only path to sustainably higher growth.”

Food prices went up around the world following Russia’s invasion of Ukraine, which was one of the factors pushing up prices at supermarket tills.

The war disrupted supplies from the two countries, which are major exporters of goods such as sunflower oil, wheat, and fertiliser.

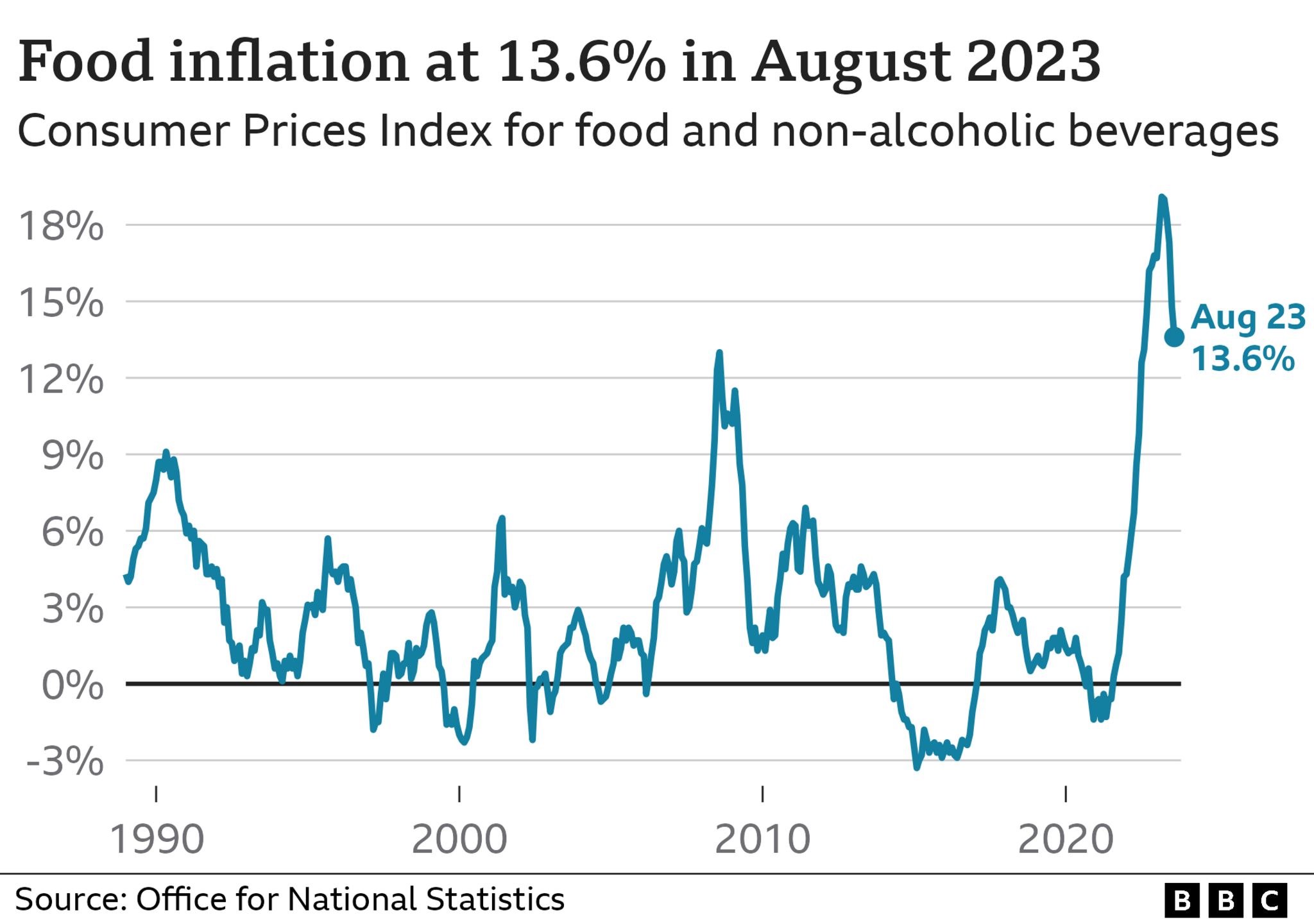

But the rate of food inflation, while still very high and in double digits, has been slowing in recent months.

Price rises for food and non-alcoholic drinks eased to 13.6% in the year to August, down from 14.9% in July, according to the Office for National Statistics (ONS).

Grant Fitzner, chief economist at the ONS, said it remained “a mixed picture”, with the price of some items such as bread and cereals still going up, while others are falling.

“So in the latest month we’ve seen falls in fish, in oils and fats and in vegetables,” he told BBC Radio 4’s Today programme.

“Food manufacturers are paying less for food than a year ago,” he added, and this is “starting to pass through to consumers.”

The drop is potentially good news for consumers who have seen shopping and restaurant bills soar.

Nick Collins runs Lounges PLC, which owns cafes, bars, restaurants and roadside diners. He told the BBC that rising food costs had forced him to put up prices by 8% across the business over the last year.

“In normal years, we’d increase our prices by around 1.5% or 2%,” he said.

However, Mr Collins said he had seen “absolutely no shift in customer behaviour” and people were not “tightening their belts”.

“It they were you’d see fewer people out at the start of the week. You’d see less spending as you approach payday… We haven’t seen any of that.”

What does this mean for interest rates?

Since December 2021, the Bank of England has put up interest rates 14 times in a row to try to curb rising prices.

But these latest figures raise questions over whether the Bank will increase them again at its next meeting on Thursday.

While at 6.7% inflation remains high and well above target, it has now fallen for three months consecutively.

All in all, this will give some support to officials on the Bank’s Monetary Policy Committee – which set rates – who want to limit further rate rises. Another rise tomorrow, from 5.25% to 5.5%, is still likely, but that could be the last one.

The latest inflation data also suggests the government is more likely to meet its pledge to halve inflation this year.

Speaking to reporters on Wednesday the chancellor said: “The independent forecasters are saying that we are on track to meet the prime minister’s target, so let’s see what happens.”

However, inflation in the UK remains stubbornly high compared to other rich countries.

On Tuesday, a new forecast from the Organisation for Economic Co-operation and Development suggested prices will rise faster in the UK than any other advanced economy this year.