Interest rate hikes by central banks around the world could trigger a global recession in 2023, the World Bank has said.

Central banks have raised rates “with a degree of synchronicity not seen over the past five decades” to tackle soaring prices, it said.

Raising rates makes borrowing more expensive to try to bring down the pace of price rises.

But it also makes loans more costly, which can slow economic growth.

The warning from the World Bank comes ahead of monetary policy meetings by the US Federal Reserve and Bank of England, which are expected to increase key interest rates next week.

On Thursday, the World Bank said the global economy was in its steepest slowdown following a post-recession recovery since 1970.

It said a study found that “the world’s three largest economies – the US, China and the euro area – have been slowing sharply”.

“Under the circumstances, even a moderate hit to the global economy over the next year could tip it into recession,” it said.

Signs of economic difficulties are already emerging. On Thursday, delivery giant FedEx warned investors that a sharp and unexpected slowdown in activity, especially in Asia and Europe, would cause revenue to be hundreds of millions of dollars short of forecasts.

The firm said it planned to close dozens of offices and reduce service in response to the drop in demand.

The news sparked a widespread sell-off of FedEx shares, sending them down more than 20%. Shares in other delivery firms, including Amazon, Deutsche Post and Royal Mail, also fell.

In the face of recession risk, the World Bank called on central banks to coordinate their actions and “communicate policy decisions clearly” to “reduce the degree of tightening needed”.

Inflation, which is the rate at which prices rise, hit a 40-year-high in the US and UK in recent months.

This was driven by higher demand as pandemic restrictions eased, and as the war in Ukraine boosted energy, fuel and food prices.

In response, central bank policymakers have raised interest rates to cool demand from households and businesses.

However, big rate increases increase the risk of recession as it can cause an economy to slow. Central banks do not typically run policy decisions by their counterparts.

Central banks do not typically run policy decisions by their counterparts.

They have in the past, however, coordinated their actions to support the global economy.

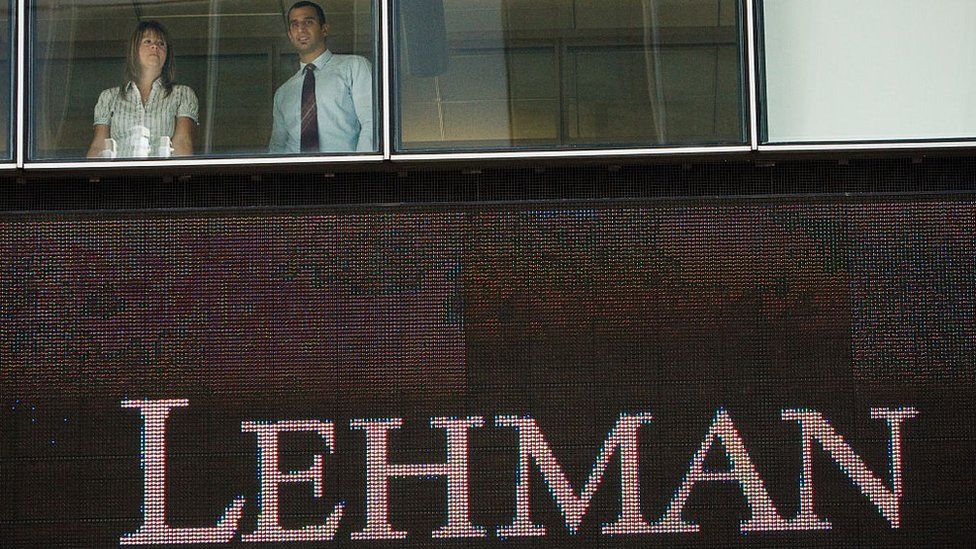

In 2007, a global financial crisis was precipitated by a subprime mortgage crisis in the US.

This developed into a full-blown crash after the collapse of the Lehman Brothers investment bank in September 2008.

A month later, the Fed, along with the European Central Bank and central banks in Canada, Sweden and Switzerland, jointly lowered their key interest rates.

They said in a statement that the “intensification of the financial crisis has augmented the downside risks to growth and thus has diminished further the upside risks to price stability”.

“Some easing of global monetary conditions is therefore warranted,” they added.