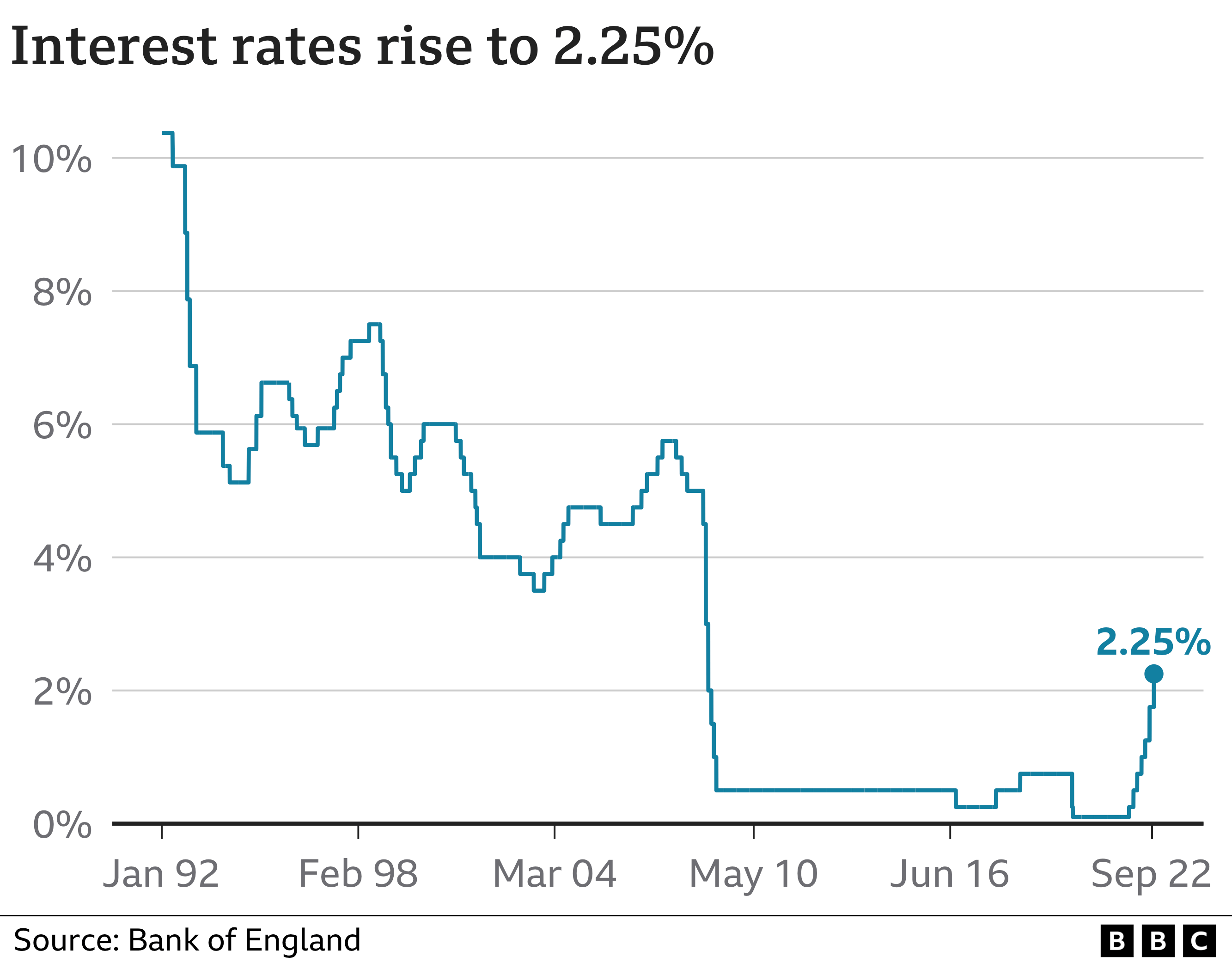

Interest rates are predicted to rise sharply on Thursday as the Bank of England continues to use its powers to tackle soaring prices.

The Bank is expected to increase its benchmark rate from 2.25% to 3%.

That would be its eighth consecutive increase since December, pushing the rate to its highest level for 14 years.

It would also mark the biggest single increase since 1989, and could have a big impact on the cost of living and people’s finances.

How high could interest rates go?

On 22 September, the Bank of England raised rates by 0.5 percentage points to 2.25%.

Analysts suggest rates could reach 4.75% next year, although that peak is lower than predictions had suggested a few weeks ago, when the government was in some turmoil after its mini-budget was badly received.

The Bank’s monetary policy committee meets eight times a year to decide interest rate policy.

It is under pressure to put rates up because it has a target to keep inflation at 2%, but prices are currently rising at about five times that level.

Considerable uncertainty remains around the government’s economic policy, with a key Autumn Statement due to be delivered by the chancellor on 17 November.

How do interest rates affect me?

Mortgages

Just under a third of households have a mortgage, according to the government’s English Housing Survey.

After a period of ultra-low rates, many homeowners are now facing the possibility of much more expensive monthly repayments.

When interest rates rise, about 1.6 million people on tracker and variable rate deals usually see an immediate increase in their monthly payments.

If the Bank rate increases from 2.25% to 3%, those on a typical tracker mortgage will pay about £73.50 more a month. Those on standard variable rate mortgages would face a £46 jump.

This comes on top of increases following the previous recent rate rises. Compared with pre-December 2021, average tracker mortgage customers would be paying about £284 more a month, and variable mortgage holders about £179 more.

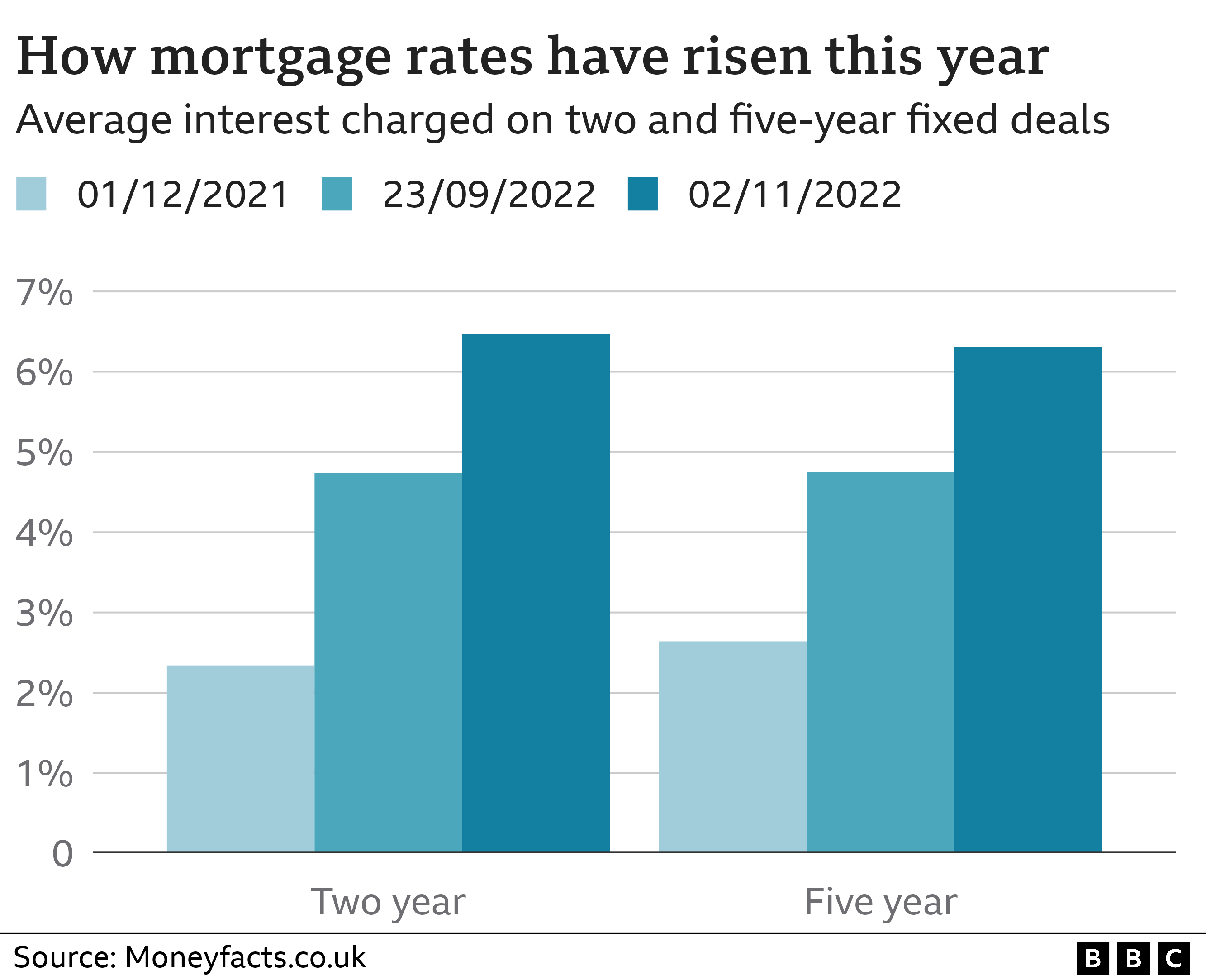

There is also an impact on fixed deals, which about three-quarters of mortgage customers hold.

Their monthly payments may not change immediately, but with lenders now anticipating higher rates, any new deals will be more expensive. That means new house buyers – or anyone seeking to remortgage – will also have to pay more.

There has also been considerable upheaval in this market since September’s mini-budget, even though most of the policies that were announced have now been ditched.

An average two-year fixed deal which was 2.29% in November 2021 is now 6.47% – a difference of hundreds of pounds each month in repayments for a typical borrower.

Credit cards and loans

Bank of England interest rates also influence the amount charged on things like credit cards, bank loans and car loans.

Even ahead of the latest decision, the average annual interest rate in September was 20.83% on bank overdrafts and 18.96% on credit cards.

Lenders could decide to put prices up further, in expectation of higher interest rates in the future.

Savings

Individual banks and building societies usually pass on interest rate rises to customers. The deals being offered now are better than anything seen for years.

But although this means savers get a higher return on their money, interest rates are not keeping up with rising prices.

This means the value of cash savings is falling in real terms.

Why does increasing interest rates help lower inflation?

The Bank has been putting rates up to combat rising prices – known as inflation.

Prices have been going up quickly worldwide, as Covid restrictions eased and consumers spent more.

Many firms have problems getting enough goods to sell. And with more buyers chasing too few goods, prices have increased.

There has also been a very sharp rise in oil and gas costs – a problem made worse by Russia’s invasion of Ukraine.

Raising interest rates helps to control inflation by making it more expensive to borrow money. This encourages people to borrow and spend less, and save more.

However, it is a tough balancing act as the Bank does not want to slow the economy too much.

Since the global financial crisis of 2008, UK interest rates have been at historically low levels. Last year saw rates of 0.1%.

Are other countries raising their interest rates?

The UK is affected by prices rising across the globe. So there is a limit as to how effective UK interest rate rises will be.

However, other countries are taking a similar approach, and have also been raising interest rates.

The US central bank has announced big rate rises, taking its key rate to the highest level for 15 years.

Other central banks around the world have also raised rates, as inflation continues to cause problems in a host of major economies.