The UK economy will shrink and perform worse than other advanced economies, including Russia, as the cost of living continues to hit households, the International Monetary Fund has said.

The IMF said the economy will contract by 0.6% in 2023, rather than grow slightly as previously predicted.

However, the IMF also said that it thinks the UK is now “on the right track”.

Chancellor Jeremy Hunt said the UK outperformed many forecasts last year.

But shadow chancellor Rachel Reeves said the figures showed the UK “lagging behind our peers”.

The IMF, which works to stabilise economic growth, said it had downgraded its forecast for the UK because of its high energy prices, rising mortgage costs and increased taxes, as well as persistent worker shortages. It did not mention Brexit in its report as a factor for the UK not performing as well as others. Today marks three years since the UK left the EU.

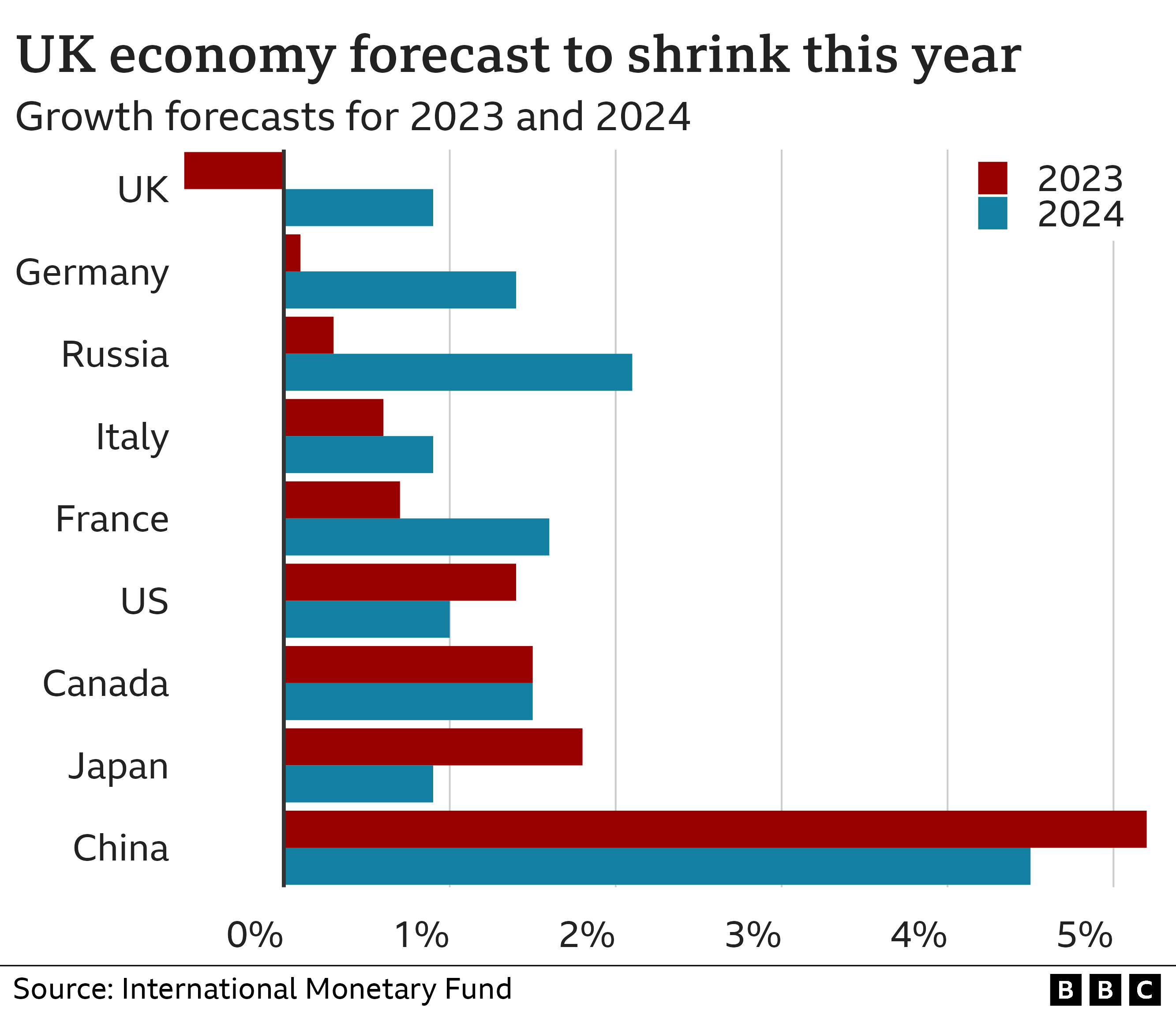

The UK is expected be the only country to shrink next year across all the advanced and emerging economies. Even sanctions-hit Russia is now forecast to grow this year.

If a country’s economy shrinks, typically this means companies make less money and the number of people unemployed rises.

IMF chief economist Pierre-Olivier Gourinchas told the BBC that last year, the UK had “one of the strongest growth numbers in Europe”, having expanded by 4.1%.

Figures released on Tuesday indicated that the Eurozone grew by 3.5% in 2022, while the economy of the whole European Union expanded by 3.6%.

Mr Gourinchas said this year’s forecast for the UK reflected its “high dependence” on expensive liquid natural gas, which had driven up the cost of living.

He said the government plans since November when it set out its spending plans in the Autumn Statement showed the UK was “certainly trying to carefully navigate these different challenges and we think that they are on the right track”.

The IMF expects the UK to grow in 2024, revising up its forecast to 0.9% from 0.6%.

Paul Johnson, director of the Institute for Fiscal Studies, said that the IMF’s forecasts were not always right, and he noted the fund was “actually being more optimistic than it was a few months ago”.

Forecasts from the Bank of England due later this week are likely to be more positive than they were two or three months ago, he added.

“My best guess is that the economy will be broadly stagnant this year. That we’re not going to get much in the way of growth but we’re not going to have a deep recession either,” he told the BBC’s Today programme.

“Now that’s not great, particularly as we should be bouncing back more strongly from Covid and particularly as we’ve not been growing terribly well for the last decade and more.”

A forecast such as this on its own, even from the world’s most important international economic institution is just that, a forecast. But the value can come when it tells a different story across all the countries it surveys.

In this case, the UK looks like an outlier. It was the only country to see a marked downgrade to growth forecasts since the autumn, and the only major G7 country to be forecast to contract this year.

The short answer is that the UK economic environment has worsened after September’s mini-budget. The tax and interest rate rises required will slow the UK economy in particular alongside the more common shock of still high energy prices.

The longer answer is that the IMF is not the only august institution wondering about economic hits affecting the UK.

The IMF’s bleak picture for the UK comes after Mr Hunt warned it was “unlikely” that there would be room for any “significant” tax cuts in the Spring Budget.

The chancellor, who has been under pressure from some in his party to cut taxes to stimulate the economy, has said that lowering inflation “is the best tax cut right now”.

Inflation – the rate at which prices rise – remains close to its highest level for 40 years.

Prime Minister Rishi Sunak has pledged to halve inflation by the end of the year, but many expect this to happen anyway largely due to a slowdown in energy price rises and as post-pandemic supply problems ease.

The government’s official independent forecaster the Office for Budget Responsibility (OBR) expects inflation, which measures the rate of price rises, to fall to 3.75% by the end of this year – well below half the current level.

Andrew Bailey, the governor of the Bank of England, has also said inflation is likely to fall rapidly this year but has warned a UK recession is still on the cards.

While the IMF predicts the UK economy will contract, it forecasts economic growth of 1.4% in the US, 0.1% in Germany and 0.7% in France.

Mr Hunt said the IMF’s figures “confirm we are not immune to the pressures hitting nearly all advanced economies”.

“Short-term challenges should not obscure our long-term prospects – the UK outperformed many forecasts last year, and if we stick to our plan to halve inflation, the UK is still predicted to grow faster than Germany and Japan over the coming years,” he added.

Economic forecasters are not always right when it comes to predicting the future. The IMF has said its forecasts for most advanced economies like the UK’s have more often than not been within about 1.5 percentage points of what actually happens.

The IMF said the trend of central banks putting up interest rates to try to curb inflation and the war in Ukraine continued to “weigh on economic activity” across the world.

But it said China reopening its economy from Covid restrictions “paved the way for a faster-than-expected recovery” globally.