A new 2,000-peso banknote will be issued in Argentina in response to soaring inflation, the country’s central bank (BCRA) has confirmed.

The new note – which will be worth $11 (£9) officially – comes after consumer prices jumped by nearly 95% in the 12 months to the end of December.

It marks Argentina’s fastest pace of inflation since 1991.

The largest current bill, the 1,000-peso note, is worth just $2.70 on the alternative markets.

Writing on Twitter, the BCRA said the new note would “commemorate the development of science and medicine in Argentina”.

It will feature pioneering doctors Cecilia Grierson and Ramón Carrillo, it added – although it is not clear when the note will enter circulation.

When Argentina’s current currency was introduced in 1992, its value was pegged at one US dollar.

But that fixed exchange rate system was abandoned after the financial crisis that engulfed the country in 2001 and 2002.

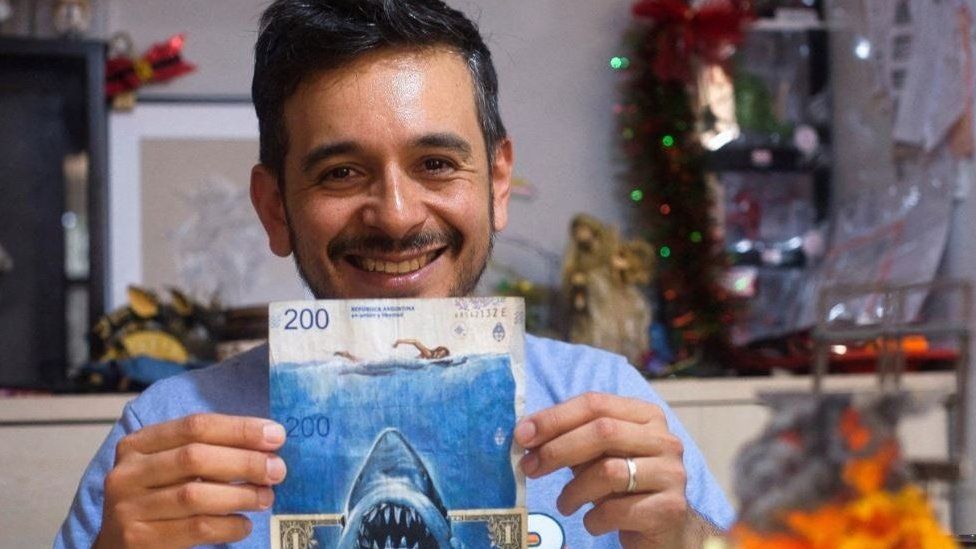

Since then, the peso has lost so much of its value that one local artist uses banknotes for painting on, because they are cheaper than a canvas.

Sergio Diaz, of Salta, recently painted a picture depicting Steven Spielberg’s movie Jaws as a parody of Argentina’s ever-increasing inflation.

Argentina has seen prices rise sharply as the cost of commodities, including energy, has gone up.

Soaring prices have largely been attributed to a bout of central bank money-printing, as well as the war in Ukraine.

In December, the International Monetary Fund (IMF) approved another $6bn (£4.9bn) of bailout money for South America’s second largest economy.

It was the latest payout for Argentina in a 30-month programme that is expected to reach a total of $44bn.

Last summer, the troubled country had three economy ministers in the space of just four weeks.

In September, the central bank also raised its main rate of interest to 75% as it tried to rein in the soaring cost of living.

Earlier this week, Brazil and Argentina announced plans to create a common currency that would be used to boost trade between the two countries.

The country’s leaders said they needed to find ways to finance commerce without relying on US dollars – although discussions are at an early stage.