Four more communities have been earmarked for shared banking hubs – becoming the latest on a list of 27 areas waiting for services to begin.

At these hubs, customers of any bank will be able to access their accounts, deposit cash and cheques, and withdraw money at any time.

Only two have opened so far, while hundreds of bank branches have closed.

Fears have been raised that local businesses and vulnerable residents would struggle without cash services.

The four new locations which will receive hubs are: Bury Park in Bedfordshire, Haslemere in Surrey, Prestatyn in Denbighshire, and Welling in south east London.

Residents and local politicians requested the hubs come to their areas owing to previous closures of bank premises.

Teresa O’Neill, leader of Bexley Council, said she was thrilled a hub was coming to Welling.

“Since losing our last banks almost a year ago, the community has not had convenient access to cash, meaning that residents have had to travel for basic banking needs.

“This is also damaging to businesses who rely on banks to cash their takings too. We look forward to the change it will make within the town.”

The BBC visited a prototype shared banking hub in Rochford, Essex, and was told it had been “a lifeline” for many people living in the area after the last branch in town closed.

Running costs are the same as a small branch, but are shared between different banking groups that use it.

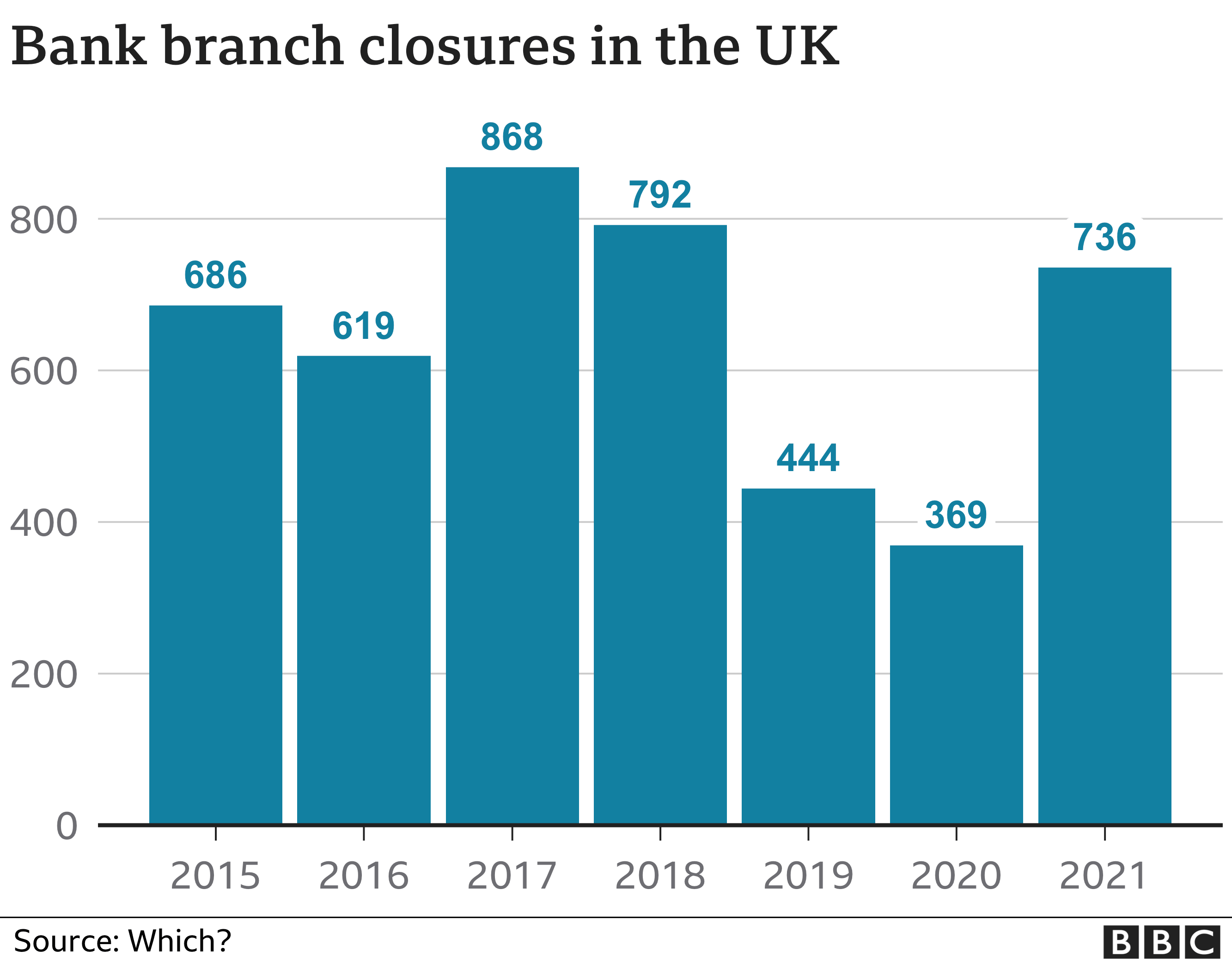

However, there is concern that regular bank branches are closing at a rapid rate. Consumer group Which? said that 587 branches have closed this year, with another 75 scheduled to shut by the end of 2022, on top of hundreds in previous years.

There is little chance of these new hubs replacing many of these closed banks at the moment.

Difficulties in opening the new hubs have included finding suitable premises, and making it fully accessible and secure enough for banking services.

Natalie Ceeney, who chairs the Cash Action Group and Banking Hub Company, said: “We are expecting a couple more to be live before Christmas. We are making good progress with all hubs and expect a significant number to open in early 2023.

“When we are visiting locations that will get a hub, we are looking for buildings that are the right size, located in an appropriate location and have the facilities to support all customers. We then often need to make changes to the building to make them suitable for a banking hub, some of which need us to get planning permission. This process has not always been easy, but we are making good progress.

“What is important is this time last year, if a community lost their last branch, there was no solution. Over the next couple of years, we expect to be supporting hundreds of communities across the UK.”

Jenny Ross, money editor at Which?, said: “Banking hubs could play an important role in ensuring the cash needs of local communities are met. However, the rollout is taking far too long and the hubs must open as soon as possible so consumers can benefit.”

In addition to the hubs, more withdrawal and deposit machines – which are unstaffed but can allow businesses to cash in their takings – will be placed in premises such as libraries and community centres and available during their opening hours.

They will be located in Bingley in West Yorkshire, Finchley in north London, Leigh-on-Sea in Essex, Melksham in Wiltshire, Plympton in Devon, and Sandbach in Cheshire.