The pound rose and government borrowing costs fell on Monday, as investors welcomed the announcement by Chancellor Jeremy Hunt of the reversal of most of the mini-budget tax measures.

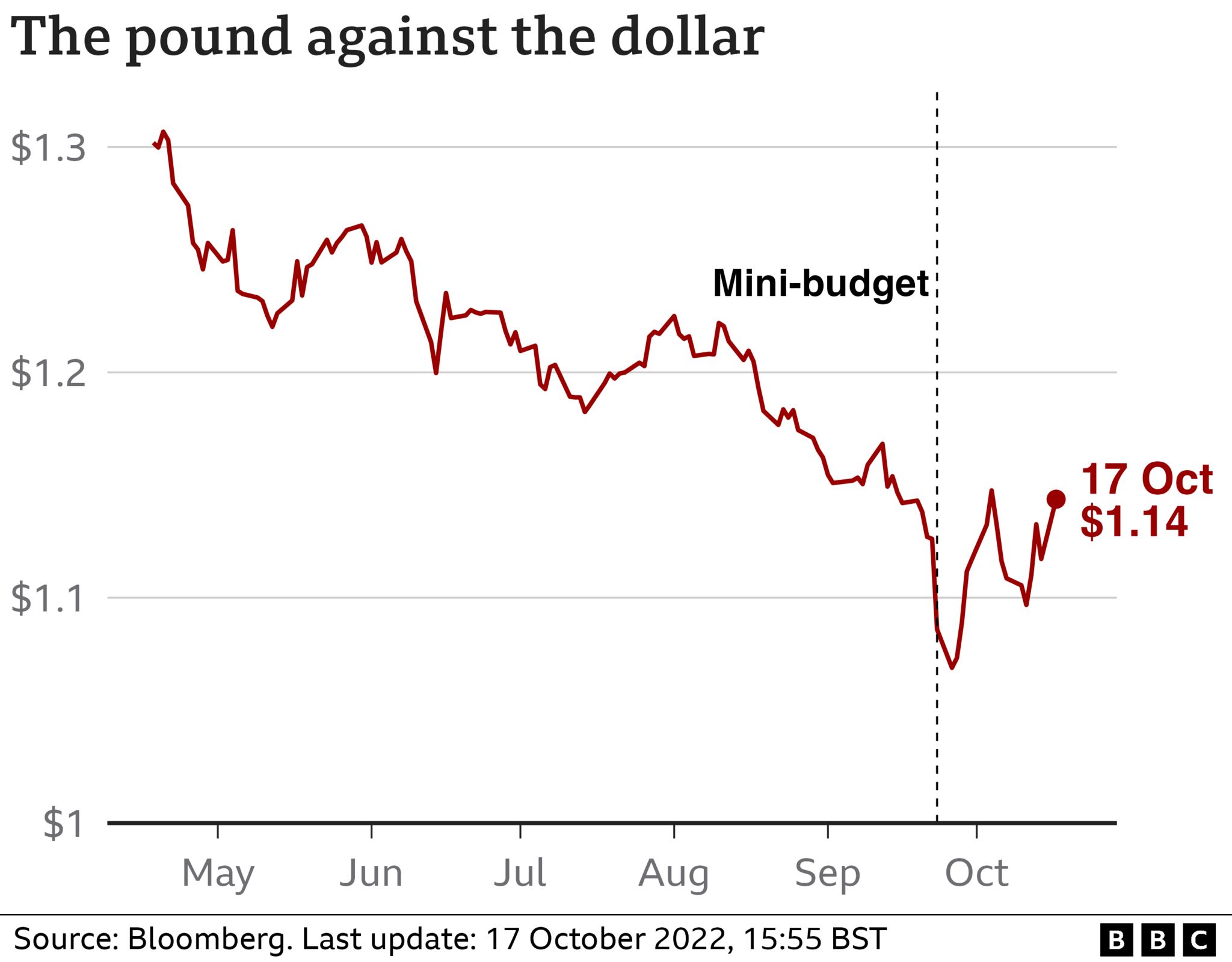

Sterling extended gains against the dollar, and is trading at around $1.14.

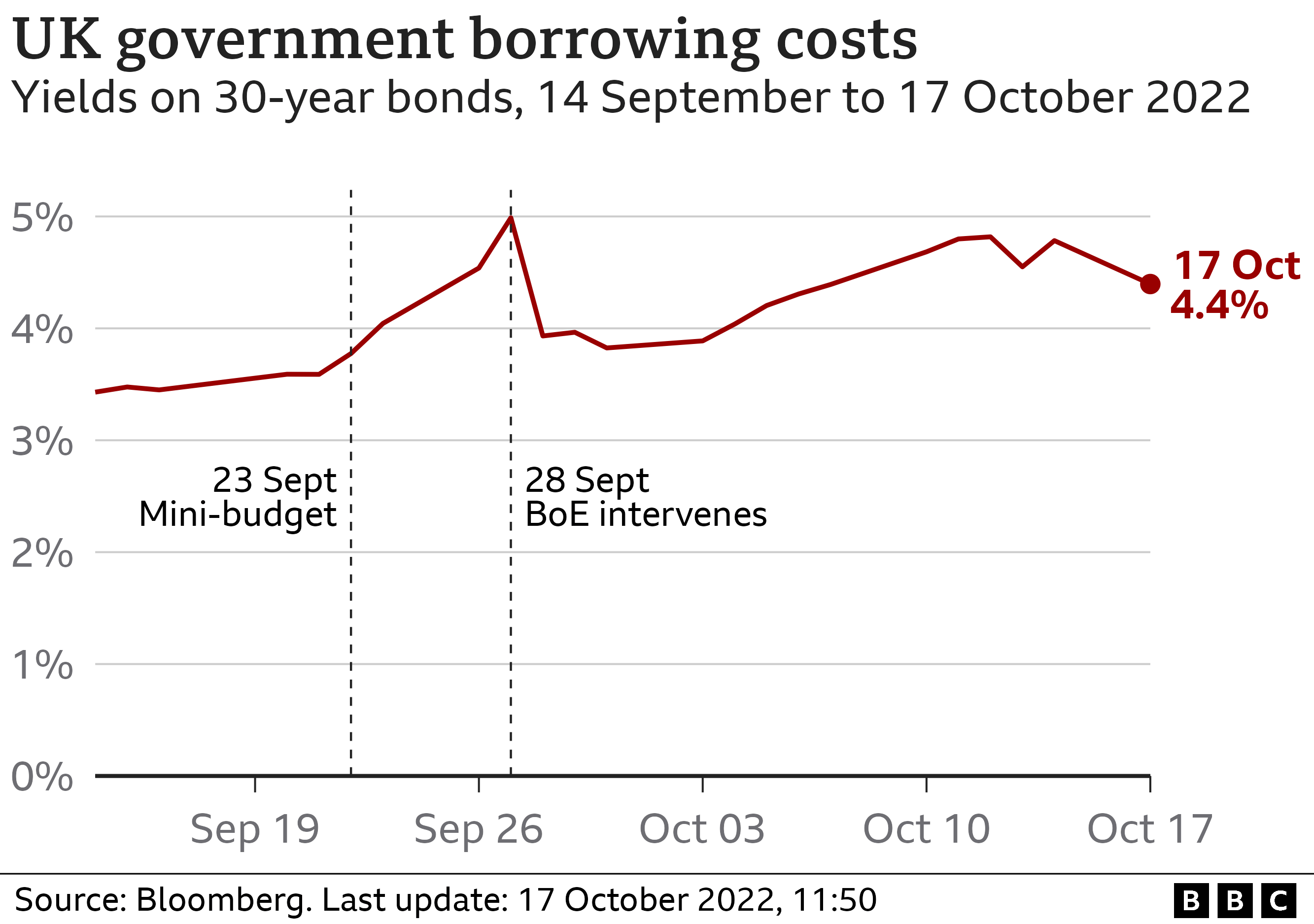

The news also saw the interest rate – or yield – on UK government bonds fall, making government borrowing less expensive.

However, analysts said tough decisions remained ahead on government spending.

An update to the government’s mini-budget had been scheduled for 31 October, but Mr Hunt brought forward many billions of pounds worth of tax and spending measures in a bid to reassure the markets.

The changes will see a planned cut in income tax scrapped, while a cap on energy bills that had been due to last two years is now only guaranteed until April next year, when it will be reviewed.

In a statement, the Treasury said the chancellor had “taken these decisions to ensure the UK’s economic stability and to provide confidence in the government’s commitment to fiscal discipline”.

Victoria Scholar, head of investment at Interactive Investor, said: “Jeremy Hunt’s focus on reassuring the markets and reinstating confidence appears to have worked so far with gilt yields trading lower and sterling pushing higher.”

However, she added that question marks will remain until the chancellor outlines on 31 October how he plans to cut government spending “in order to plug the multi-billion pound budget shortfall, raising concerns about the prospect of a new era of austerity”.

An utterly extraordinary unBudget – perhaps the biggest U-turn in British economic history.

£45bn of unfunded tax cuts has in three weeks and three days seen a £32bn reversal.

We may need new terminology. U-turn suggests a controlled manoeuvre. This is like a plane trying to do the jet engine equivalent of a handbrake turn.

But it will have real impacts, especially the decision to target the energy help after April.

There are reasonable questions now about higher taxes and less help as we enter a recession.

Much of this has been inevitable since the Monday after the mini-budget. It should help regain economic credibility.

But it is such a political volte face that one wonders if the whole cabinet, government and Conservative party will support it.

The new chancellor’s message will be this: there is no alternative.

On Friday, Prime Minister Liz Truss sacked Kwasi Kwarteng as chancellor and said the mini-budget “went further and faster than markets were expecting”.

The mini-budget was blamed for causing turmoil in the financial markets, with the pound slumping to a record low of $1.03 and the cost of government borrowing rising sharply in its aftermath.

However, Friday’s announcement of the £18bn U-turn on corporation tax and the firing of Mr Kwarteng did not appear to reassure investors, with UK government borrowing costs climbing on Friday afternoon.

There had been fears of more turmoil on Monday, with the UK government bond market trading for the first time since the end of the Bank of England’s emergency support programme.

However, the news of the latest U-turn led to the cost of government borrowing falling across a range of bonds traded on the financial markets.

The yield on bonds due to be repaid in 30 years’ time dropped on Monday morning as markets anticipated Mr Hunt would reverse tax cuts, and fell further after he did so in his statement, to 4.35%.

It had hit 5.17% on 28 September in the aftermath of the mini-budget.

However, the yield is still higher than it was before the mini-budget, when it stood at 3.7%.

“Markets seem prepared to give Jeremy Hunt the chance to turn back the clock,” said Danni Hewson, financial analyst at AJ Bell. “The new chancellor has bought the government some breathing space.

“But markets are fickle and two weeks is a long time in economics, as in politics. It’s a pretty easy and obvious step to reverse most of those unfunded tax cuts announced in the mini-budget but it’s less straightforward to move the debate along. And that’s where the real risk lies. Austerity might not be palatable, but it seems to be on the table.”

The shift in the government’s economic policies and market turmoil in recent weeks had led to Goldman Sachs downgrading its forecasts for UK economic growth.

On Sunday, the investment bank revised its 2023 UK economic output forecast from a 0.4% drop to a 1% drop.

Goldman said it expected a “more significant recession in the UK”, in part due to “significantly tighter financial conditions” and the planned higher corporation tax rate from next April.